Pensions

Whether you’re a foreigner or a Japanese citizen, if you’re between the ages of 20 and 59, you have to participate in the country’s pension system. Under the system, Japan’s working population pays a premium to support the elderly, the disabled, and bereaved families. Think of it as a form of mutual aid among all residents of Japan. There are two kinds of pensions: the National Pension (also known as the Basic Pension) and the Employees’ Pension. Every taxpayer pays into the National Pension, but some employed by private businesses additionally pay into the Employees’ Pension; they are known as Category II Insured Persons. We will now discuss both types of pensions below.

How to Participate In Japan’s Pension Systems

National Pension (Basic Pension)

This is a pension that everyone residing in Japan (foreigners included) between the ages of 20 and 59 has to participate in. There are three types of people insured under the National Pension system:

Types of Insured People and Ways of Participating

Category I Insured Person

Anyone who isn’t a Category II and III Insured Person fits here: the self-employed, students, the unemployed etc. Those without Japanese citizenship staying in the country on a medical stay or long-term tourist visa are exempt.

Participating in the National Pension System as a Category I Insured Person

If you’ve entered Japan after turning 20, you have to complete your resident registration, then head over to your city/ward office or the nearest pension office and register there.

If you’ve entered Japan before turning 20, you will receive a National Pension Insured Person Qualification Notice at your registered address about a month before your 20th birthday. Take it to your city/ward office and register there.

Category II Insured Person

A company employee or public servant paying into the Employees’ Pension system. All those paying into the Employees’ Pension or mutual aid funds are also paying into the National Pension system. The National Pension contributions are taken from the Employees’ Pension or mutual aid fund premiums, so you don’t need to pay into it separately.

Participating in the National Pension System as a Category II Insured Person

All of the paperwork will be taken care of by your employer, and the premiums will be deducted from your salary, so you don’t need to do anything. For more information, talk directly to your employer.

Category III Insured Person

A Category II Insured Person’s dependent spouse who is between the ages of 20 and 59 years and resides in Japan.

* In some circumstances, those temporarily traveling abroad may also count as a Category III Insured Person.

Participating in the National Pension System as a Category III Insured Person

The paperwork for this category will be taken care of by the employer of a spouse who is a Category II Insured Person. For more information, talk directly to your spouse’s employer. Category III Insured People pay no premiums, which are all handled by a Category II Insured Person.

Employees’ Pension

An Employee’s Pension is a system that a Category II Insured Person pays into in addition to the National Pension. Under this system, your employer matches your pension contributions, which are deducted from your salary. A lot of companies mandate paying into this system, but it ultimately depends on the size of the company and the industry. For more information, talk to the person in charge of pensions at your company.

How to Pay Into the Employees’ Pension System

If you get hired by a company with an Employees’ Pension system, you will be covered by it from your first day, so make sure you send the company all the necessary paperwork beforehand. At many companies, an employee in charge of pensions will distribute all the documents you’ll need, so just follow their instructions.

Special Pension Provisions

Social Security Agreements

Social Security Agreements are reached to avoid double contribution payments in Japan and abroad, and to ease the pension participation period requirements necessary to be eligible for social security benefits. Foreigners coming from countries that have a Social Security Agreement with Japan (of which there are 20 as of August 2020) can expect the following adjustments to their social security arrangements. Note that the details of these agreements differ from country to country, so you should look into your own country’s agreement.

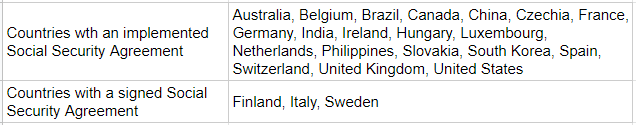

Japan has signed an agreement with 23 countries, 20 of which have implemented it (as of October 1, 2019):

Applicability Adjustment

Those foreigners who are paying into the pension systems in their home countries and then come to Japan and pay into its pension system are effectively paying double contributions. To help avoid that, it’s been decided that those staying less than five years in Japan will only have to follow their home country’s social security system, while those staying in Japan longer than five years will only have to follow Japan’s system.

Pension Participation Period Calculations

A Japanese pension is a set amount of money paid every month to people 65 years or older, but in order to receive it, you first have to have paid your pension premiums for at least 10 years. So, first, your pension participation period must be calculated, and with this adjustment, the pension participation period from your home country can be counted towards your participation period in Japan and vice versa.

Background and Purposes of a Social Security Agreement

Status of Social Security Agreements with Other Countries

Lump-Sum Withdrawals

If a person without Japanese citizenship stops being insured by the National Pension or Employees’ Pension systems and leaves Japan, they can request a lump-sum withdrawal of their pension. The qualifying conditions for lump-sum withdrawals are as follows.

A person who stops being insured by the National Pension, Employees’ Pension, or mutual aid fund systems can request a lump-sum withdrawal within two years of leaving Japan if they meet the following four conditions.

1) You’re not a citizen of Japan.

2) You’ve been insured by the Employees’ Pension system for at least six months, or you’ve been insured by the National Pension system as a Category I Insured Person for at least six months, calculated so that:

– any months with a 1/4 exemption are multiplied by a factor of 3/4,

– any months with a 1/2 exemption are multiplied by a factor of 1/2,

– any months with a 3/4 exemption are multiplied by a factor of 1/4.

3) You’re no longer residing in Japan.

4) You’ve never been entitled to pension benefits (including Disability Allowance) before.

In other words, those foreigners who have paid National Pension contributions or were covered by the Employees’ Pension system for at least six months, but who have not met the requirement of being insured for 10 years (disqualifying them from receiving a pension), can still receive a one-time lump-sum withdrawal, the amount of which depends on the length of their pension participation period. Many people from countries without a Social Security Agreement with Japan tend to request lump-sum withdrawals.

Please Note:

If you receive a lump-sum withdrawal, it will be calculated based on your pension participation period, which will then cease to be counted towards the qualifying period needed to receive a full pension. Additionally, if you have been insured under a pension system for at least 10 years, which qualifies you to a retirement pension in Japan, you cannot request a lump-sum withdrawal.

How to Request a Lump-Sum Withdrawal

After leaving Japan, you can request a lump-sum withdrawal by sending in your application together with all the necessary documentation to the Japan Pension Service via mail. Besides the application (link below), you’ll also need your pension book or another document with your basic pension number, a photocopy of your passport, a document proving you no longer reside in Japan (you don’t have to do this if you’ve delivered a moving-out notification to your city or ward office before leaving Japan), and a document with your banking information (contact, branch name, address, account number, account name etc.). To verify what kind of documents you’ll need, please visit your nearest pension office before returning to your home country.

Lump-Sum Withdrawal Application Forms (multiple languages) – Japan Pension Service

Special Payment System for Students

Everyone residing in Japan, including foreigners, becomes insured under the National Pension system when they turn 20 and is obligated by law to pay their insurance premiums. However, students can apply to have their contribution payments postponed for the duration of their studies under the Special Payment System for Students. However, only students earning less than the following amount qualify:

* Applicant’s maximum qualifying income (in 2020):

1,180,000 yen + Number of Dependent Relatives x 380,000 yen + Social Insurance Premium Deduction

How to Apply

You can apply for the Special Payment System for Students at the National Pension window at your local city/ward/town/village office, your nearest pension office, or at your school (if they’re authorized to handle such applications.) You’ll need an application form, your pension book or another document with your basic pension number, and proof that you’re an active student. You can also apply via mail by sending all the necessary documents to your local city/ward/town/village office.

Please Note

Whether you qualify for the Special Payment System for Students depends on your status. You should qualify if you’re a regular foreign student or foreign research worker, but if you’re not, then this special provision does not apply to you. To confirm if you or your school qualify, please ask your school directly or consult with the appropriate people at your city/town/pension office.

Special Payment System for Students and List of Qualifying Schools (Japanese)

Overview of the Special Payment System for Students (English)

Health Insurance

Japan has a national health insurance system where every citizen is insured under some plan, and everyone helps with each other’s medical expenses. The characteristic of this system is that it allows everyone to choose which medical facility to visit and always get high-quality care for low prices. Foreigners staying in Japan for more than three months have to get health insurance. Those employed by a Japanese company get health insurance for companies (called social insurance), while everyone else gets National Health Insurance.

Company vs. National Health Insurance

Health insurance for companies is managed by companies or organizations and covers their employees. The premium is calculated based on the level of a person’s base monthly income and the insurance rate, which the company and the employee later share. The employee’s half is deducted from their salary. What sets this system apart from the National Health Insurance is that it has a system for “Dependents,” i.e. family members with low income who can get health insurance under the social insurance system.

National Health Insurance, on the other hand, is managed by local municipalities and covers those not insured by their companies or public assistance programs like students, the self-employed, and the unemployed. The premiums are calculated based on one’s student status, income, family make-up etc. and supplemented in part by the local municipality, but it all depends on the governing body, so the fees differ by region. Additionally, the National Health Insurance premiums are calculated for the entire household, represented by the taxpaying head of the household. This means that household members covered under the National Health Insurance system do not pay their premiums individually. Both health insurance systems are equal, so if you’re getting social insurance from your company, you don’t need to get National Health Insurance.

Pros of Having Insurance

By having a type of public insurance, you’ll end up paying less for medical costs, something that affects most people. The exact amount you’ll have to pay out of pocket differs depending on your age and income, but it is 30% at most. There are also additional provisions (discussed below) that alleviate costs even further. Health insurance for companies (social insurance) often have additional programs to help out their employees.

Health Insurance Assistance Programs

High-Cost Medical Care Benefit System: This program caps your monthly medical expenses at a set amount determined by your age and income. Once you exceed it, you don’t have to pay anything.

Child Healthcare: This program covers a portion of medical expenses involving children below a set age, with the amount determined by your age and local municipalities.

One-Off Payment for Childbirth: An amount of money paid to a mother from her health insurance after she gives birth, set at 420,000 yen per child.

Allowance for the Sick and Wounded: If you lose your salary due to sickness or injury, this program will pay you 2/3rds of your daily wages (calculated as 1/30th of your average monthly salary from the 12 months before the welfare payout began).

Medical Expenses Allowance for Meals During Hospitalization: This program pays for three set-price meals a day during hospitalization. (The details of this program may differ by the region and your circumstances.)

How to Get Health Insurance

Health Insurance for Companies (Social Insurance)

The specifics of health insurance for companies (social insurance) differ depending on the company, with each one having different application forms and requiring different documents. Every company has a dedicated employee in charge of insurance, so you should follow their instructions when submitting your application. You will be insured by your company from the first day you join it, so it’s normal to receive instructions from the person in charge of insurance before your first day. If you’re already paying for National Health Insurance but have gotten a job and want to switch to the health insurance for companies (social insurance), you’ll need to submit a report of withdrawal from the NHI at the appropriate window at your local city/ward office. If you don’t, you’ll needlessly end up paying into two insurance systems.

National Health Insurance

Those qualifying for National Health Insurance must apply for the NHI at the city/ward/town/village office where they’ve submitted their resident registration form, within 14 days of meeting any of the following four conditions:

- Submitting a resident registration form at a city/ward office after entering the country.

- Registering at a new city/ward/town/village office.

- Giving birth.

- Losing your social insurance (counted from one day after leaving the company).

To apply for National Health Insurance, you’ll need your passport, resident card, and your My Number. Additionally, some people may also have to submit their certificate of quitting or their maternity passbook.

Things to Keep in Mind When Applying

There are certain conditions you have to meet to qualify for Japanese health insurance. For example, you have to be staying in Japan for more than 3 months and your visa cannot be of the Stopover, Diplomatic, or Designated Activities variety. In addition, if you hail from one of the countries with a Social Security Agreement with Japan (which also covers health insurance), your health insurance is effectively regulated by both countries, so you should find out the specifics of your individual insurance situation.

Furthermore, if you’re a part-time or temp worker, you can only qualify for health insurance for companies (social insurance) under certain conditions, like if you work at least 3/4th as many days as full-time employees or your regular working hours exceed 20 hours a week. To find out if you qualify for social insurance, please consult directly with the person responsible for insurance at your company.

Labour Insurance

Labour insurance covers both workers’ accident compensation insurance and employment insurance. Every worker, be they full-time, part-time or temp, has to have it, even if they’re the only employee at their company.

Workmen’s Accident Compensation Insurance

Workers’ accident compensation insurance is paid by your employer; employees do not have to contribute. If an employee suffers an accident due to their work (duties) or their commute and is injured, falls ill, or dies as a result, then the workers’ accident compensation insurance will pay out a settlement to them or their surviving family. It’s mainly used to pay for medical expenses or lost wages due to not being able to work. Every worker in Japan, from those employed by corporations to single-proprietorship businesses, including part-time and temp foreigners, qualifies for this insurance.

Employment Insurance

If a worker loses their job or has trouble continuing their current work, or have enrolled in an educational/training program, then they are entitled to money to support their current employment situation or help them find new work. That’s all handled by employment insurance. To qualify for the program, you need to be working at least 20 hours a week and plan to work at your job for at least 31 days. However, some people who meet those requirements will not qualify for employment insurance like those working in specific industries or full-time students. To find out if you qualify, please consult directly with your employer. Employment insurance is paid for by the worker and the employer. With the exclusion of some industries, most workers have to only pay 0.3% of their salary into employment insurance.

How to Check Your Salary Deductions

You can pay your taxes, insurance premiums, and pension contributions either directly or indirectly. If you’re employed by a company, then your employer will make most of the payments for you (indirect approach) by deducting (天引き/ 手取り額) them from your salary (額面) every month. Please look for those terms on your pay slip/salary statement.

Most of the deductions will go to social insurance, including health insurance premiums, welfare insurance premiums, and employment insurance premiums, written as 社会保険料(健康保険料、厚生年金保険料、雇用保険料), as well as taxes, including income tax and municipal resident taxes, or 税金(国の所得税や地方住民税). You might feel cheated out of this money, but you’re not losing that money: the company is simply acting on your behalf and making those payments in your stead, so that you don’t have to bother with complex forms and you’ll never forget to pay your dues. It’s actually all to your benefit!

When it comes to Japanese taxes, various systems have been put in place, and which one applies to you depends on your visa status, income, country of origin, and many other personal details. You can get a lot of information online or in pamphlets, but it will be all lists and tables, so you may not be able to find the answers that you’re looking for. Taxes are complicated, but we hope that this guide helped you ascertain your situation, and if there are things that you’re still unclear about, we recommend you consult directly with your employer or with your local help desk.

The information in this article is accurate at the time of publication.

If you want to give feedback on any of our articles, you have an idea that you’d really like to see come to life, or you just have a question on Japan, hit us up on our Facebook!

The information in this article is accurate at the time of publication.